InvestEngine Review 2025

At-a-glance

- ✅ Safe – FCA-regulated and cash protected by the FSCS up to £85 000.

- ✅ No fees – DIY investors pay £0 platform or dealing charges on 800 + ETFs.

- ✅ Start small – open with £100, then buy ETF slices from just £1.

- ✅ Tax wrappers included – ISA and the new SIPP are free to hold.

- ✅ Well-liked app – Trustpilot score hovers around 4.6/5 for ease of use.

- ⛔ ETFs only – no individual shares, crypto or CFDs.

- ⛔ Trades run once a day – batched around 3 :15 pm, so not instant.

- ⛔ No Junior or Lifetime ISA yet – both wrappers still “on the roadmap”.

- ⛔ Online support only – chat or email; no routine phone line.

- ⛔ £100 first deposit required – smaller sums can’t open an account.

InvestEngine InvestEngine | |

| ⭐ Rating: | 3.5 ★★★★★ |

| 🏅 Overall rank: | #7 out of #8 |

| 💵 Price: | 0% platform fee (DIY portfolios) |

| ✂️ Free version: | Yes (zero fees DIY) |

| 💻 Platforms: | Web, iOS, Android |

| 🔥 Offer: | Up to £100 welcome bonus |

| Get InvestEngine Now | |

Test Scope & Devices

To keep things hands-on, I opened both a Stocks & Shares ISA and a plain General Investment Account on InvestEngine, hopping between the web dashboard and the iOS/Android apps. After stumping up the £100 minimum in each, I pushed roughly £2 k of ETF orders through to see how the dealing screen, portfolio tools and overall user-experience behaved under fire. I also flicked on the robo kit—Savings Plans and automatic rebalancing—inside a managed portfolio just to watch it think for itself. Everything below reflects testing done in mid-2025.

Regulation & Trust

InvestEngine (UK) Ltd ticks every regulatory box that matters. It holds an FCA licence, parks client cash in segregated trust accounts at NatWest, and your first £85 k is wrapped in the FSCS safety net. ETFs live in a nominee account on CREST (Euroclear UK & Ireland), so the platform can’t legally touch them; even if InvestEngine or its custodian went under, your holdings stay yours.

On the security front you get the usual industry-grade defences—SSL encryption, continuous monitoring, the works.

The numbers are moving the right way too. Assets under management have rocketed from £28 m (Mar 2022) to £149 m (Mar 2023) and cracked £1 bn by early 2025. Yes, it still posted an operating loss in 2023 while pouring cash into growth, but a fresh funding round in 2024 keeps the lights (and servers) on.

Reputation? Solid. Trustpilot sits around 4.6/5, and the trophy shelf now includes MoneyWeek’s “Reader’s Choice” (2024) and a five-star nod from the FT’s Investors’ Chronicle. Which? also stamps its ISA as “Great Value”.

Claim a random bonus of £20–£100 when you open an InvestEngine ISA or General Investment account and invest just £100. Sign up here — your bonus will be credited within 5 business days and must be held for 12 months to qualify.

Fees & Commissions

InvestEngine keeps your cost sheet almost suspiciously clean: 0 % platform fee, £0 dealing commission, and no inactivity or FX surprises. Run your own money and you pay only the ETF’s built‑in OCF and the market spread. Prefer auto‑pilot? A LifePlan portfolio costs a flat 0.25 % a year – that’s the lot.

| Cost line | DIY / ISA / Business | Managed (LifePlan) |

| Platform / account fee | 0 % p.a. | 0.25 % p.a. |

| Dealing commission | £0 on all ETFs | £0 on all ETFs |

| ETF OCF | from ~0.03 % | ~0.12 % avg |

| FX conversion | None (ETFs in GBP) | None |

| Deposits / withdrawals | £0 | £0 |

| Inactivity fee | £0 | £0 |

Spreads on the most‑traded ETFs usually land between 0.02 – 0.10 % during London hours.

What that means in practice

- Commission‑free really is commission‑free. Every ETF ticket costs £0, period.

- DIY platform fee? Zero. You pay only the ETF’s own OCF (from ~0.03 %).

- LifePlan still cheap. Managed portfolios cost a flat 0.25 % p.a. with no sneaky extras.

- No FX drag. All funds trade in sterling, so there’s nothing to skim.

- No admin gotchas. Deposits and withdrawals are free, and there’s no inactivity toll.

- Spreads stay slim. Liquid ETFs rarely stray beyond a 10‑bp gap.

- Kickback‑free zone. InvestEngine earns nothing from ETF providers, so any discounts land in your pocket.

VAT? None. Financial trading is VAT‑exempt in the UK.

Our take

If you’re a buy‑and‑hold ETF investor, InvestEngine’s fee menu is about as lean as it gets. Run your own portfolio and your ongoing cost is basically the ETF’s OCF and a wafer‑thin spread. Even the managed LifePlan undercuts most rivals at 0.25 % p.a. – tidy enough to keep compounding on track.

Product Range

InvestEngine is a one-trick pony, but it’s a thoroughbred: ETFs, and nothing else.

Choice overload in a good way

More than 820 trackers from iShares, Vanguard, Fidelity and pals, slicing every corner of the market: FTSE 100, S&P 500, emerging-markets, gilts, junk bonds, gold – you name it.

£1 slices

Fractional dealing means you can build a proper pie chart with pocket-money stakes. Diversification for the price of a coffee.

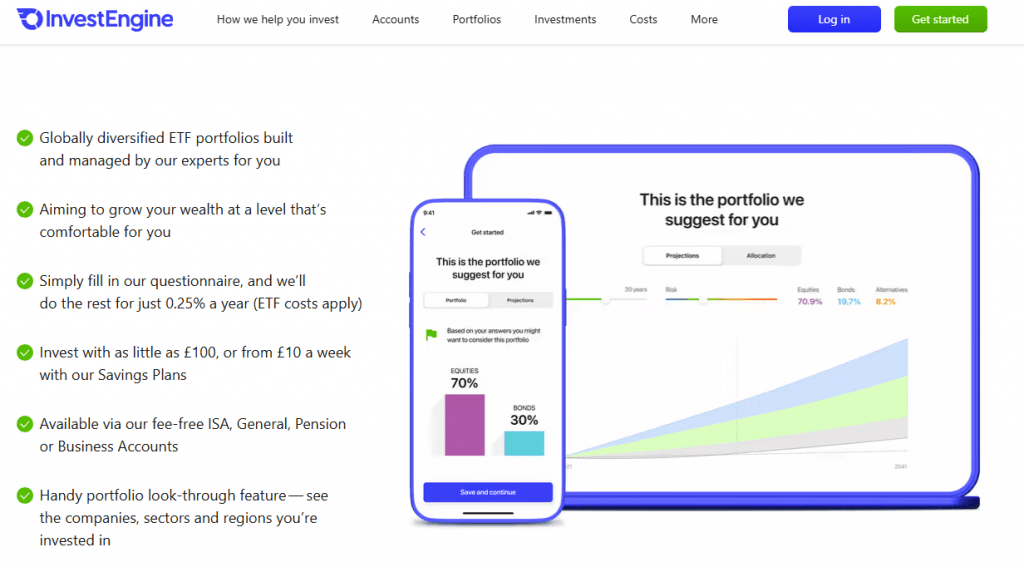

Hands-free mode

The managed portfolios (still colloquially “LifePlan”) bundle those ETFs into risk-graded mixes and rebalance every quarter. The convenience fee: 0.25 % a year. Think robo-advisor without the glossy TV ads.

All the right wrappers

Stocks & Shares ISA, SIPP, bog-standard taxable GIA and even a Limited Company account. The ISA is flexible, so you can yo-yo funds within the tax year without burning allowance.

What’s missing

No Junior ISA or Lifetime ISA yet (pencilled in but not live), and forget single-stock punts, CFDs or crypto. If you crave meme-stock fireworks, you’ll need a different provider.

Bottom line: InvestEngine is purpose-built for low-cost, ETF-centric portfolios. If that’s your jam, the range is broad enough to keep most asset-allocation geeks busy. If you want Tesla shares, leverage or Bitcoin, look elsewhere.

Platform Features

InvestEngine’s interface sticks to the same philosophy as its fees: keep it simple and stay out of the way.

Same feel everywhere

Web, iOS, Android… they’re practically clones. The home screen hands you headline numbers and recent performance without forcing you to spelunk through menus.

Dashboard that speaks plain English

Toggle between ISA, GIA or SIPP, and everything—cash, holdings, gain/loss—is right there. Hover tool-tips and a built-in glossary keep beginners from Googling jargon mid-trade.

X-ray vision for portfolios

Click ‘Analytics’ and the platform peels back every ETF to show sector, country and top-holding splits. Handy pie charts replace the usual Excel torture.

ETF finder with proper filters

Sort the 800-plus funds by region, asset class, provider or benchmark in seconds; no need to scroll through alphabet soup.

Rebalancing on autopilot

Managed portfolios realign quarterly (or sooner if markets lurch). DIY investors get a one-click ‘Rebalance’ button. Set up AutoInvest and fresh cash is drip-fed into your chosen weights automatically.

Trade-offs:

- Only market orders, once a day – everything batches around 3:15 pm, so forget limit orders or scalp-trading.

- Spartan on bells and whistles – no Level 2 data, no fancy screeners, no multi-indicator chart gymnastics. Technical traders will be twiddling their thumbs.

Bottom line: The UI nudges you towards low-cost, long-term investing and makes the admin painless. If you crave flashing candlesticks and rapid-fire execution, look elsewhere; if you want clarity and calm, you’ll feel right at home.

(Credit: InvestEngine/NeoSpot)

Order Execution

InvestEngine doesn’t do live-fire trading; it runs a once-a-day batch. Here’s how the cadence works:

Cut-off

Fire in your instruction before 2 pm (UK) and it joins that day’s queue; anything after 2 pm rolls to the next business day.

Launch window

Around 3:15 pm the platform sweeps up every queued order and sends them to market as plain-vanilla market orders. No faffing with partial fills or limit prices.

No backsies

Once an order hits the queue, you can’t yank it. Plan accordingly.

Costs

Still £0 commission; the only friction is the ETF’s bid-ask spread, which on liquid funds is usually only a handful of basis points. Our test trades cleared at mid-market levels with no eyebrow-raising slippage.

Settlement

Standard T+2. Cash from a sale lands two working days later.

Takeaway: the system is dead simple and reliably priced, but it’s not for day-traders who need minute-by-minute finesse. For anyone building a long-term ETF stack, the daily batch model is more than fast enough—and it keeps the fee meter stuck on zero.

Open your first InvestEngine account through this link and claim the current £25 welcome bonus. Fund £100, grab the bonus, then use £1 fractional ETFs to put every penny to work. T&Cs apply.

Research and Education

InvestEngine keeps the learning curve gentle rather than throwing users into a library. The headline resource is its Insights blog: quick-fire market notes, ETF primers and what-to-do-when-everything-is-red think-pieces. Dip into the mobile app and you’ll find a built-in glossary that translates City jargon into plain English, plus a portfolio analyser that spells out allocation, yield and running costs in one glance.

If you prefer moving pictures, there’s a modest webinar schedule and a YouTube strand—Ask InvestEngine—walking through platform tricks and the nuts and bolts of ETF investing. The community forum does the rest: users talk shop, swap tips and occasionally drag the staff in for a straight answer.

What you won’t get is Bloomberg-level kit: no stock screeners, no multi-indicator chart carnival, no deep research PDFs. Compared with the big-box brokers it’s lightweight, and deliberately so. The materials are pitched at beginners and solidly intermediate investors who want to understand index funds, not dissect balance sheets.

In short, the education package is enough to steer a newcomer, but if you fancy yourself the next Warren Buffett you’ll still need an external research terminal—or at least a good bookcase.

(Credit: InvestEngine/NeoSpot)

Opening an Account

Opening an InvestEngine account really is hassle-free. Pop in your name, address and National Insurance number and the platform’s automated ID check usually waves you through in seconds—no forms, no envelopes. If the database can’t place you, take a quick snap of your passport or driving licence and a proof-of-address bill, upload them in-app and you’re away.

Once verified, simply choose your wrapper—ISA, GIA, SIPP or Business—then drop in the £100 minimum. Cash arrives instantly via Open Banking (TrueLayer) or a standard bank transfer; our test funds were showing almost immediately. Selling and withdrawing is just as painless: trade, wait the standard T+2 settlement and transfer the money back to your bank for free. ISA users keep their allowance courtesy of InvestEngine’s flexible-ISA rules.

Support is fully online. Live chat runs most of the day (05:30–23:00 weekdays, 07:00–22:00 weekends) and responses land in minutes; email typically turns round inside 24 hours. Between that, a detailed FAQ and an active community forum, answers are easy to find.

Quick take:

- Fast, paper-free sign-up: automated ID check clears most users in seconds; manual upload is plan B.

- £100 to get started: pick any wrapper (ISA, GIA, SIPP or Business) and fund instantly, fee-free.

- Zero-cost exits: sell, settle in T+2 and withdraw with no charges; ISA flexibility lets you replace funds in-year.

- Online-only help that works: quick live chat, responsive email, comprehensive FAQ and community forum.

Final Verdict

InvestEngine nails what it sets out to do: offer British investors a dead-simple, dirt-cheap way to build an ETF portfolio. DIY users pay no platform fee, just the fund’s own microscopic OCF and a wafer-thin spread. Add the £1 fractional slices, flexible ISA/SIPP wrappers and a tidy dashboard, and you’ve got a dream set-up for anyone following a long-term, buy-and-hold strategy. Prefer autopilot? The LifePlan portfolios give you robo-style convenience for 0.25 % a year.

The flip side is equally clear: if you crave single shares, crypto, fancy order types or intraday thrills, look elsewhere. The once-a-day execution window and the absence of Junior or Lifetime ISAs may also be deal-breakers for some.

Ideal for:

- UK investors who want an ultra-low-cost ETF platform.

- Beginners and passive savers seeking a free ISA or SIPP with solid customer support.

- Hands-off types who like robo rebalancing but hate robo fees.

Less suitable for:

- Active traders chasing individual stocks, FX, crypto or rapid execution.

- Parents hunting for Junior/Lifetime ISA wrappers (still “coming soon”).

For its target audience, though, InvestEngine delivers exceptional value, FCA-grade safety nets and customer ratings to match. Hard to ask for more at this price.

Frequently Asked Questions

Q. Is InvestEngine regulated by the FCA in the UK?

A. Yes. InvestEngine (UK) Ltd is fully authorised and regulated by the UK Financial Conduct Authority (FCA) under Firm Reference Number 801128.

Q. Is InvestEngine safe and reliable for UK investors?

A. Client cash is ring-fenced at NatWest and covered by the Financial Services Compensation Scheme (FSCS) up to £85,000. Exchange-traded funds are held in a Euroclear nominee account, and the platform uses bank-grade encryption—ticking every FCA safety box.

Q. What fees and charges does InvestEngine apply?

A. DIY accounts are fee-free: 0 % platform charge and £0 dealing commission. Managed LifePlan portfolios cost 0.25 % per year. You pay only each ETF’s Ongoing Charge Figure (OCF) and the normal market spread; deposits, withdrawals and FX conversions are all free.

Q. Does InvestEngine offer a Stocks & Shares ISA?

A. Absolutely. InvestEngine’s flexible Stocks & Shares ISA lets you invest up to the £20,000 annual allowance in low-cost ETFs with zero platform fees—and you can withdraw and redeposit within the tax year without losing allowance.

Q. How do I withdraw money from InvestEngine?

A. Sell your ETFs, wait the standard T+2 settlement, then move the cash to your linked bank account free of charge. Most withdrawals land within one to two working days.

Q. What is the minimum deposit for InvestEngine?

A. The initial deposit is £100. After that you can invest from just £1 per ETF thanks to fractional investing.

Q. Does InvestEngine support fractional ETF investing?

A. Yes. You can buy fractional slices of any ETF from only £1, making portfolio diversification easy for beginners and small accounts.

Q. When does InvestEngine execute orders?

A. Orders entered before 14:00 UK time are batched and executed around 15:15 that day; anything after 14:00 rolls to the next business day. All trades are market orders—there are no intraday or limit orders.