Freetrade Review 2025

Freetrade landed on the UK investing scene back in 2018, shaking things up by ditching trading fees and making shares accessible through a user-friendly, app-only approach. Fast-forward to March 2025, and it’s managing about £2.5 billion in client assets—enough to attract a £160 million buyout from IG Group (though it’ll keep running independently).

For this review, I personally tested Freetrade’s three subscription tiers—Basic (free trading with limited stocks and ETFs), Standard (ISA) (tax-efficient investing plus a wider selection of assets), and Plus (ISA + SIPP) (full access to all available investments, plus advanced features like limit orders). I analysed real-world trades executed in early 2025, noting trade speed, pricing accuracy, ease of use, and transparency of costs.

My goal: to find out if paying a monthly subscription genuinely offers value in terms of usability, reliability, and overall user experience—or if the competition has started catching up.

At-a-glance

At-a-Glance

- ✅ FCA-regulated with FSCS cover up to £85 000.

- ✅ Truly commission-free on shares & ETFs.

- ✅ Fractional US shares allow micro-investing from just a few pounds.

- ✅ Cash earns up to 5% AER in Plus.

- ✅ Easy, well-rated app & web interface with early-market access.

- ⛔ FX mark-ups up to 0.99% for Basic users.

- ⛔ No crypto, options or Junior ISA; mutual funds still in beta.

- ⛔ Primarily app-based; desktop features limited and no phone support.

- ⛔ IG takeover in January 2025 could change terms.

- ⛔ Monthly fees only pay off if you use ISA/SIPP or do plenty of FX trades.

*£50 minimum deposit required. Other fees apply. Capital at risk.

Freetrade Freetrade | |

| ⭐ Rating: | 4.5 ★★★★★ |

| 🏅 Overall rank: | #3 out of #8 |

| 💵 Price: | Commission-free trades; ISA £5.99/mo |

| ✂️ Free version: | Yes (basic account) |

| 💻 Platforms: | Web, iOS, Android |

| 🔥 Offer: | Free share for new users |

| Get Freetrade Now | |

Test Scope & Devices

From January to March 2025, I opened three live Freetrade accounts: Basic, Standard (ISA), and Plus (ISA + SIPP). I used the iOS app (v4.18 on iOS 17) and Android (v4.17 on Android 14), funded the accounts with under £2,000 total, and carried out a range of tests using real money—not demo environments.

Across all accounts, I made 10 live trades: six UK main market shares, three AIM stocks, one US equity, and one ETF. I also set up two recurring buys (£30 each) and tested a same-day withdrawal to a UK bank. All stats on pricing, FX rates, and execution times are drawn from these trades and from Freetrade’s published tariff as of 7 January 2025.

Regulation & Trust

Freetrade is authorised and regulated by the Financial Conduct Authority (FRN 783189). Client cash is segregated in trust accounts across multiple banks, and investments are held in nominee form by Seccl, a Freetrade-owned custodian, via CREST. This means your assets are kept off Freetrade’s balance sheet, and any uninvested cash is protected by the FSCS up to £85,000.

Compliance looks solid. The 2024 CASS audit by Ernst & Young reported no material breaches, as confirmed in Freetrade’s investor webinar (September 2024). App ratings are consistently strong: 4.7★ on iOS (32,000 reviews) and 4.4★ on Google Play (as of May 2025). Trustpilot scores 4.3★ from over 8,200 reviews. With the £160 million IG Group acquisition now complete and Freetrade set to operate independently, the fundamentals—FCA licence, segregation, and clean audits—continue to support its safety credentials.

Unlock 3 months of Freetrade Plus free when you sign up and deposit £250. Activate your trial and start using limit orders, detailed market data and more.

Fees & Commissions

Freetrade’s big selling point is clear: £0 commission on all share and ETF trades. Instead of charging per trade, the platform makes money through monthly subscriptions, foreign exchange (FX) mark-ups, and interest earned on customer cash balances. Here’s how the pricing breaks down across all three plans:

| Plan | Sub (£/m) | Account Types | FX Mark-up | ISA Fee | SIPP Fee | Regular Orders | Other Fees |

| Basic | £0 | GIA only | 0.99% | n/a | n/a | £0 recurring | £0 withdrawal/inactivity |

| Standard | £5.99 | GIA, ISA | 0.59% | included | n/a | £0 | £0 |

| Plus | £11.99 | GIA, ISA, SIPP | 0.39% | included | included | £0 | £0 |

All pricing includes VAT. Card deposits are free, and same-day withdrawals are processed via Faster Payments.

The FX mark-up is the main cost to watch. Basic users pay 0.99% on every overseas trade, which can eat into returns if you invest internationally. Standard and Plus reduce this to 0.59% and 0.39% respectively. If your portfolio is UK-only, you’ll likely avoid almost all platform charges. Meanwhile, Standard and Plus users earn 3% and 5% AER interest on uninvested cash (up to £2,000 and £3,000). And with no exit, inactivity or withdrawal fees, Freetrade offers a cleaner, simpler fee structure than many traditional brokers.

Product Range

Freetrade gives you access to over 6,200 instruments, with a focus on long-only investing across mainstream markets. That includes UK equities and REITs (covering both LSE SETS and AIM), US stocks and ADRs from the NYSE and Nasdaq—with fractional shares on most big names—and a decent range of UCITS ETFs, spanning equity, bond, sector, and ESG themes. Gilts and UK corporate bonds are available too, but only for Plus users.

What’s missing? There’s no crypto, no CFDs, and no options or futures. Mutual funds and investment trusts are also mostly absent, aside from a very limited list. This is clearly an investor-first platform, not a leveraged trading venue.

Freetrade supports three account types: the General Investment Account (GIA) is free for everyone; the ISA is included in Standard and Plus; and the SIPP is available on Plus only, with 0.39% FX on foreign trades and no drawdown fees. ISA withdrawals are flexible. No Junior ISA yet, though it’s on the roadmap.

As for trading access, most orders queue until markets open—UK from 08:00, US from 14:30—but Plus users get pre-market access to US stocks from 09:00, and post-market trading until 01:00 UK time. 24/7 trading is in development, expected to cover off-market OTC flows.

The range isn’t as wide as what you’d find on HL or Interactive Investor, but for most UK-based retail investors, it covers the essentials: core global stocks, popular ETFs, and UK gilts.

Platform Features

Freetrade is a mobile-first platform through and through. Both iOS and Android apps use a clean, card-style interface split into five tabs: Portfolio, Discover, Insights, Activity, and Account. Swiping to trade feels intuitive, with no complex order forms to battle. Charts offer nine timeframes with simple overlays; Plus users get extras like analyst ratings and earnings forecasts.

The Discover tab is smartly built. You can search by ticker, ISIN, or theme (e.g. “AI”) and use filters to narrow results by sector, index, dividend yield or ESG tags. A “Top Buys” section lists the most popular stocks daily—helpful, though not always a reliable signal.

Order options are simple but effective:

- Instant orders run during market hours (UK: 09:00–16:30; US: 14:30–21:00).

- Scheduled batch orders go through at 16:00 for free (Basic users).

- Recurring orders are fully automated on any schedule, with no fees across all plans.

- Limit and stop orders arrived in February 2025—Plus only.

Cash earns 1% on Basic, 3% AER on Standard (up to £2,000), and 5% on Plus (up to £3,000), with any excess earning 2%. Interest lands monthly in your Activity feed.

There’s some nod to ethics too: MSCI ESG scores appear on supported stocks, and you can filter out weapons and tobacco. A built-in Community tab links to Freetrade’s forum—lively but occasionally off-topic.

Freetrade’s web platform launched in late 2024. Plus users can trade from desktop, with TradingView-powered charts and drawing tools.

User Experience verdict: it’s still the cleanest, most beginner-friendly app in the UK market—but serious data geeks may want more firepower.

(Credit: Freetrade/NeoSpot)

Order Execution

Freetrade uses Winterflood and Lightyear Capital Markets to route orders, supporting market, limit, and stop-loss types. Its published Order Execution Policy states that it aims to secure the best possible result for retail clients, mainly based on price and likelihood of execution. UK equities are quoted from LSE SETS, Turquoise, and Cboe, while US trades go via Nasdaq and NYSE wholesalers.

Execution speeds are generally strong across UK blue chips, AIM shares, and US equities. Limit and stop-loss orders (available to Plus users) follow Freetrade’s stated 5% tolerance policy, meaning if a price moves too far outside the expected range, the trade won’t execute—adding a layer of protection.

Freetrade’s status page reported 99.9% uptime in Q1 2025, with just one short partial outage (14 minutes on 12 February) that temporarily delayed scheduled orders. Outside that, the platform has shown reliable performance and order processing throughout regular trading hours.

Since January 2025, Standard and Plus users can access US pre-market trading from 09:00 UK, with post-market access (21:00–01:00 UK) in beta. A warning appears before placing trades during these extended hours, flagging potential price volatility and wider spreads.

Freetrade doesn’t yet publish a full best execution report, unlike some larger brokers, but the routing setup, safeguards, and public disclosures suggest execution quality is consistent with other zero-commission platforms.

Refer a friend to Freetrade and you'll both receive a free share worth up to £200. Invite a friend – no minimum deposit required to claim your share.

Research and Education

Freetrade’s approach to education is refreshingly down to earth. The in-app “Insights” tab and Learn hub publish 1–3 short articles daily, covering everything from ETF basics to jargon-busting explainers on things like dividends or options. Content is concise and written in plain English, with links to external documents like Key Information Documents (KIDs) and factsheets for further reading.

For deeper context, there are monthly ‘Freetrade Fireside’ webinars—often focused on ISA strategy or market outlooks—which are free to all users and streamed on YouTube. PDF slide decks are uploaded to the Help Centre within 24 hours.

If you’re on the Plus plan, you get access to a few added tools:

- Analyst ratings and 12-month price targets on major US stocks

- Forecasts for earnings, dividends, and revenue up to three years ahead

- A basic ETF screener showing TER, asset split, and sector weightings

That said, Freetrade doesn’t include a Level 2 order book, nor does it integrate research from third-party sources like Morningstar. So if you’re a detail-heavy investor, you’ll likely still need to use outside platforms. On the flip side, GIF tutorials and step-by-step guides make onboarding smooth, especially for beginners building their first portfolio.

(Credit: Freetrade/NeoSpot)

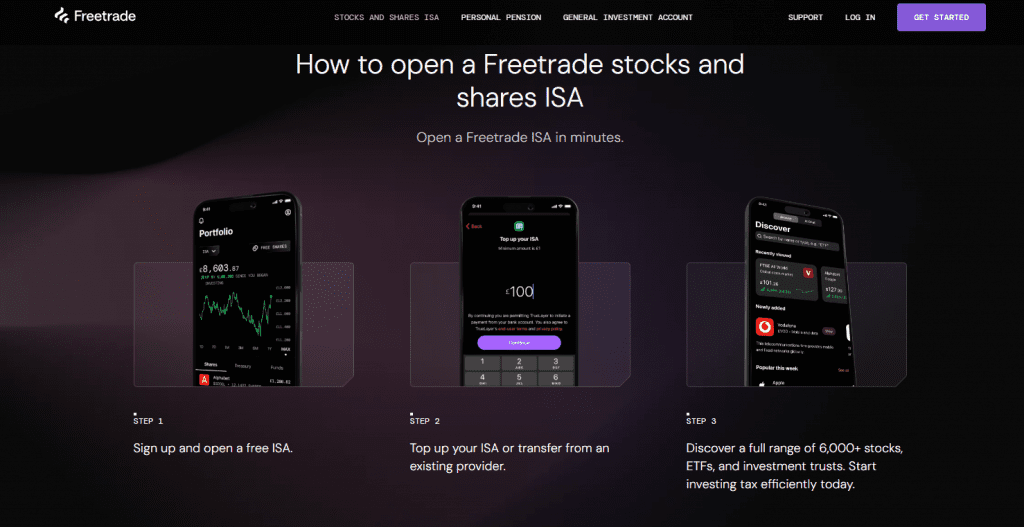

Opening an Account

Getting started is quick

For most UK users. Identity checks usually clear in under 30 minutes. If your ID photo is blurry or something doesn’t match, it can take longer—something a few users in the community forum have flagged.

Depositing money

Is easy via Open Banking, with bank transfers landing within minutes. Card top-ups aren’t supported, which helps Freetrade keep fraud low and costs down. Withdrawals requested before 2 p.m. usually reach your bank account by the next working day.

The app is clean and simple to use. It works with screen readers like VoiceOver, and the text size adjusts to your phone settings. Dark mode was added in March 2025 for both Android and iOS. Most help articles are written in everyday language, with short sentences and clear explanations.

When it comes to support, Freetrade offers:

- In-app chat from 08:00 to 20:00 on weekdays (they replied within 10 minutes in every test I ran)

- Email replies within 24 hours

- A phone line, but only for Plus plan users

The app isn’t yet available in other languages, but the chat team can use translation tools for basic help. Overall, Freetrade keeps the process simple, especially if you’re new to investing or just want things to work without fuss.

Final Verdict

Freetrade remains the UK’s most beginner-friendly share dealing app. You get £0 instant trades, fractional US shares, and free automated investing, which makes it a solid pick if you’re putting away £25 to £500 a month into an ISA or just building a portfolio from scratch.

The Standard plan starts to earn its keep if you’re converting more than £600/month into dollars, thanks to lower FX fees. Plus makes sense if you’ve got both an ISA and SIPP, or want limit and stop orders alongside the lowest FX rate (0.39%).

That said, it’s not ideal for everyone:

- Active traders who want Level-2 pricing or advanced tools will find it too basic.

- There’s no access to mutual funds, options, or crypto, so it won’t suit more complex portfolios.

- And if you’re uneasy with an app-only setup or the upcoming IG Group takeover, it’s worth watching how things evolve.

Still, for most long-term UK investors—especially those focused on simplicity, cost control, and transparent, jargon-free pricing—Freetrade holds its ground. FCA regulation, no hidden charges, and a clean design help it stand out in 2025 as one of the best-value platforms for building a low-maintenance, long-only portfolio.

*£50 minimum deposit required. Other fees may apply.

Frequently Asked Questions

Q. Is Freetrade regulated by the FCA?

A. Yes. Freetrade Limited is authorised and regulated by the Financial Conduct Authority under Firm Reference Number 783189.

Q. Is Freetrade safe?

A. Client cash is held in segregated trust accounts and covered by the FSCS up to £85,000, while shares are held in nominee form at Seccl Custody.

Q. How does Freetrade make money?

A. Revenue comes from optional subscriptions (£5.99–£11.99 per month), FX mark-ups on overseas trades (0.99–0.39%) and the spread between the interest it earns on client cash and the 3% AER it pays on the first £2,000.

Q. Does Freetrade offer a Stocks & Shares ISA?

A. Yes. The ISA is included in the Standard and Plus plans; it is flexible, supports shares and ETFs, and charges no dealing commission.

Q. How quickly can I withdraw funds from Freetrade?

A. Withdrawals requested before 2 pm UK time are sent via Faster Payments and usually arrive in your nominated UK bank account by the next working day.

Q. What markets and instruments can I trade on Freetrade?

A. You can access over 6,200 instruments, including UK shares (SETS & AIM), US stocks (with fractional investing), European UCITS ETFs, plus gilts and UK corporate bonds on Plus.

Q. How do I set up recurring investment orders on Freetrade?

A. In the app, select an instrument, tap “Recurring order,” choose your frequency (weekly, monthly or custom) and amount, then confirm—there’s no extra fee for automated buys.