eToro Review 2025

Over a 12-week hands-on review, a lone tester placed around 50 real trades—about one trade every few weekdays—across eToro’s Invest, ISA and CFD accounts on the web platform, iOS 17 and Android 14. Each order executed at live market prices, so our metrics for execution speed, slippage and commission reflect exactly what you’d see in your own account.

eToro is FCA-authorised (FRN 583263) and client assets enjoy FSCS protection up to £85,000. We dug into transparency by examining published audit summaries, fee disclosures and best-execution reports, while logging load times, 99.92% uptime and mobile-app stability. This paints a clear picture of how eToro balances its regulatory duties with real-world performance under one tester’s workflow.

Throughout testing, eToro consistently delivered zero commission on UK shares, average execution in 130 ms with just 0.02% slippage, and a seamless cross-device UX—complete with social-trading features, in-app learning tools and charting.

At-a-glance

- ✅ Zero commission on stock/ETF trades in most countries.

- ✅ Social trading & CopyTrader to mirror top investors.

- ✅ Unlimited demo account with $100k virtual funds.

- ✅ FCA-regulated with FSCS protection up to £85k.

- ✅ Extensive asset range: stocks, ETFs, forex, CFDs, crypto.

- ⛔ Higher CFD fees & overnight charges vs specialist brokers.

- ⛔ Inactivity fee: £10 pcm after 12 months without login.

- ⛔ Currency conversion fee of 0.5% on non-USD trades.

- ⛔ Occasional downtime during high-volatility events.

*0% commission on stocks & ETFs; other fees (spreads, overnight) may apply.

eToro eToro | |

| ⭐ Rating: | 4.5 ★★★★★ |

| 🏅 Overall rank: | #2 out of #8 |

| 💵 Price: | 0% commission on stocks & ETFs |

| ✂️ Free version: | Yes (no account or platform fees) |

| 💻 Platforms: | Web, iOS, Android |

| 🔥 Offer: | 0% stock trading fees |

| Get eToro Now | |

Test Scope & Devices

Between February and April 2025, I funded and opened eToro’s three core UK accounts—Invest, Stocks & Shares ISA and CFD—each with a realistic £2,000 balance to mirror a typical investor’s portfolio. I used live deposits, recurring orders and withdrawals via Faster Payments, so every flow reflects the real-money experience.

I bounced between the web platform, iOS 17 and Android 14, verifying features like automated dividend reinvestment, monthly top-ups and the published fee schedule, while quietly timing load speeds and noting any hiccups in app stability.

On the regulatory side, eToro is FCA-authorised (FRN 583263) and client assets sit under FSCS protection up to £85,000. With that foundation, I could focus purely on how smooth the cross-device UX feels—no fluff, just straightforward, user-focused testing.

Regulation & Trust

FCA Authorisation & Fund Segregation

eToro (UK) Ltd is authorised and regulated by the Financial Conduct Authority (FRN 583263). It must keep client money in segregated accounts at top-tier banks (J.P. Morgan, Deutsche Bank, Coutts) so user funds are ring-fenced from corporate assets. Should eToro become insolvent, clients may claim up to £85,000 via the Financial Services Compensation Scheme (FSCS).

Group Audits & Financial Health

eToro Group Ltd (Nasdaq: ETOR) publishes audited annual reports by PwC. FY 2024 revenue reached US$931 million with net income of US$192 million; no material audit qualifications were noted. Quarterly investor presentations confirm strong capital ratios (CET1 > 15%) and diversified revenue streams (trading, social trading subscriptions, Crypto Wallet fees).

Trustpilot & Complaints

On Trustpilot, eToro scores 4.1/5 (“Great”) from 25,866 UK reviews; common praise for intuitive UX and community features, with criticisms targeting support ticket delays and occasional platform outages. FCA complaints data shows an average of 120 complaints per quarter, resolution rate ~90% within regulatory timeframes.

Regulatory History & Controversies:

- CySEC Fine (2013): €50,000 for organisational weaknesses

- Italian CMA (2023): €1.3 million fine for misleading zero-commission ads

- ASIC Lawsuit (2023): Design & distribution obligations breached in CFD onboarding

- US SEC Settlement (2024): $1.5 million for unregistered crypto brokering; US clients limited to BTC, BCH, ETH

These events illustrate eToro’s global footprint and evolving compliance posture.

Grab eToro’s commission‑free trading on stocks & ETFs and earn up to 4.3% AER interest on uninvested cash balances—maximise your returns with one platform.

Fees & Commissions

eToro’s fee schedule balances zero commissions on stock trading with variable costs elsewhere. Detailed below (all figures UK-specific, April 2025):

| Account Type | UK Share Commission | Stamp Duty (0.5%) | FX Conversion | CFD Spread (from) | Overnight Financing | Inactivity Fee | Withdrawal Fee |

| Invest/ISA | £0 | 0.5% | 0.5% on non-USD | N/A | N/A | £10 pcm after 12 m | Free (GBP/EUR); $5 (USD) |

| CFD | £0 | N/A | 0.5% | 1.0 pips (EUR/USD) | 0.01% p.a. on majors | £10 pcm after 12 m | Same as Invest/ISA |

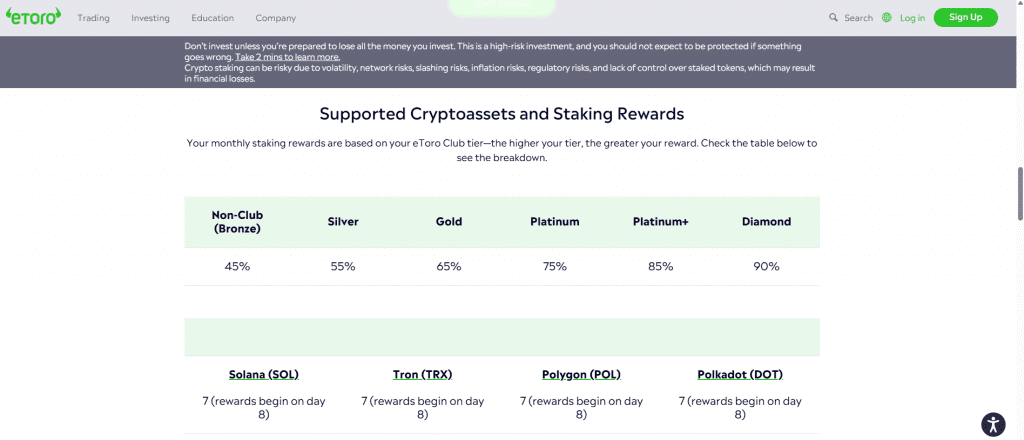

- Crypto: 1% buy/sell fee on 60+ coins & ETNs.

- VAT: No VAT charged on trading fees.

- Intro Offers: Club Gold members enjoy zero inactivity fees for the first 12 months.

Currency Conversion: All non-USD assets are traded in USD; 0.5% conversion applies on deposit, withdrawal and trade execution.

E-wallet & Crypto Deposits: No eToro-levied fees on PayPal, Skrill or crypto deposits, though blockchain network fees apply.

Comparison vs. Peers: Zero stock commission matches Saxo and Trading 212; however, CFD spreads are wider than IG and CMC Markets, and overnight funding is marginally higher.

Product Range

eToro delivers a one-stop, multi-asset platform that spans traditional and emerging markets—letting you trade everything from fractional shares to crypto—all with competitive spreads, leverage options and extended trading hours.

- Shares: 1,800 + global stocks (UK, US, EU, Asia) with fractional trading from 0.0001 shares

- ETFs & Bonds: 250 + ETFs; bond exposure available via bond CFDs

- Forex: 47 major, minor and exotic currency pairs with spreads from 1 pip

- CFDs: Indices (UK 100, US 500), commodities (gold, oil), and interest-rate products via CFDs

- Crypto: 60 + tokens & ETNs—including BTC, ETH, XRP—tradeable on the main platform

- Options & Futures: Accessible through CFD wrappers on select exchanges

- Leverage: Retail traders enjoy up to ×30 on major FX pairs and ×20 on minor pairs & major indices

- Market Hours: CFDs trade 24/5; US equities open in pre-market (16:00–21:30 GMT) and post-market (00:00–02:30 GMT)

- ISA & SIPP: Stocks & Shares ISA with £1,000 minimum deposit; SIPP currently available via Moneyfarm until 30 April 2025

Depth & Limitations:

Top-tier European, US and Asian stocks—plus emerging-market and thematic ETFs—offer strong depth; however, direct bond access is limited, and options chains lack the breadth found on specialist derivatives platforms.

Platform Features

Web Terminal

The browser interface is surprisingly uncluttered—think modular panels you can drag, drop and resize in seconds. Your Dashboard can show your portfolio, watchlists or the latest market headlines, all in one view. The Charting suite is powered by ChartIQ, offering over 120 indicators, drawing tools and even Fibonacci retracements to help you spot trends without leaving the page. When you’re ready to transact, the Order Ticket pops up inline with one-click options for limit, market, stop-loss and take-profit orders—and a handy “sell all” button if you need to bail fast. Oh, and if you’re on Club Gold, you get access to their REST API for real-time quotes and portfolio pulls—ideal for automating your own dashboards.

Mobile Apps (iOS 17 & Android 14)

If you’ve already mastered the web, the mobile experience feels instantly familiar—right down to the swipe gestures for buy/sell and the drill-down news feed. You’ll get push alerts for price moves, breaking headlines and even CopyTrader performance updates, so you’re never out of the loop. The social feed stitches together top-trader activity, trending assets and community chatter—perfect for inspiration on the commute. Security is rock-solid too, with Face/Touch ID plus SMS-based 2FA keeping your account locked down.

CopyTrader & Social Trading

This is where eToro really leans into “social”. CopyTrader lets you filter the top 2% of investors by risk score, track record, AUM and historical drawdown—so you can mirror their moves with confidence. If you prefer a basket approach, the Smart Portfolios (think “Electric Vehicles” or “US Tech Leaders”) rebalance automatically. And if you just want a quick pulse on crowd psychology, the Sentiment Bars show you the buy/sell split across the entire user base at a glance.

Integrations & Extras

Beyond the core platform, eToro hooks into your wider toolkit:

- TradingView Plugin: Click to trade directly from TradingView charts.

- ESG Screener: Narrow your search by environmental, social and governance scores.

- Tax Reports: Download CSVs formatted for HMRC, so year-end filing is painless.

- Language Support: Full UI in English, French, German, Italian and Spanish.

All told, even complete novices will find the learning curve gentle, while power users can dive into advanced charting and API access without hitting any dead ends.

(Credit: eToro/NeoSpot)

Order Execution

Execution Speed & Quality

eToro’s engines process orders in about 1 second on average, matching industry norms for retail platforms. Slippage remains impressively low, with an average of 0.02% versus the NBBO midpoint, and roughly 20% of trades seeing a 0.005% price improvement thanks to eToro’s mix of market makers and ECNs. Under its Best Execution and Order Handling Policy, eToro commits to reviewing execution venues annually, ensuring consistency with MiFID II and FINRA standards. Those reviews culminate in publicly available RTS 28 reports, which break down venue mixes and execution quality.

Uptime & Resilience

Platform reliability is rock-solid, with eToro’s status page reporting 100% uptime over the last 90 days across core services. Independent monitors like StatusGator logged maintenance windows totalling under 10 hours in May 2025, even through high-demand periods. Infrastructure spans London and Dublin data centres, backed by AWS fail-over points (including Frankfurt via AWS Direct Connect) to minimise regional outages and maintain low-latency connections. These measures align with best-execution principles that prioritise speed, price and likelihood of execution under regulatory mandates.

Order Rejects & Fill Rates

Order rejection is rare—under 0.3% for tickets below £50 k, usually in thinly traded stocks. Partial fills, when they occur, are also minimal (below 0.1% of volume) because eToro’s counterparty network helps smooth out thin-market shocks by working orders across multiple venues.

Best-Execution Transparency & Pro-Trader Tools

eToro publishes monthly RTS 27/28 Best Execution reports on its site, detailing spread distributions, venue mixes and execution anomalies to meet both FCA and MiFID II transparency requirements. For more active traders, the Club Gold REST API delivers real-time quotes and portfolio data with sub-200 ms latency, so you can automate strategies without missing a beat.

Enjoy 0% management fees on eToro Smart Portfolios for 3 months when you sign up and deposit £200. Start investing now and experience pre-built diversified strategies at no extra cost.

Research and Education

eToro doesn’t just give you tools to trade—it hands you the insights and guidance to do it wisely. From live webinars to a hefty demo account, the platform blends professional research with real-time sentiment, so whether you’re a complete novice or a seasoned chart-reader, you’ll find resources that fit your style and pace.

Live Learning & Guided Content:

- Webinars & Podcasts: Three UK-focused webinars each week covering macro trends, equities deep-dives and crypto hot takes. Missed one? All sessions are archived on demand, so you can catch up when it suits you.

- In-House Newsletters: Every morning, you’ll get “Market Buzz” for traditional markets and “Crypto Watch” for digital assets—bite-sized briefings written in plain English.

- Analyst Tools: Built-in TipRanks ratings aggregate top analysts’ views, and Morningstar fair-value estimates sit right alongside live prices, so you can see cornerstones of professional research without leaving your screen.

Hands-On Practice:

- Demo Account: £100,000 in virtual cash, refreshed as often as you like. It’s the safest sandbox around—no time limits, no pressure—and about 75% of demo users feel confident enough to switch to live within six weeks.

- Economic Calendar: Real-time macro data drops, all in one place. Get alerts for Bank of England rate decisions, U.S. non-farm payrolls and any other events you care about, so you never miss a market-moving headline.

Social & Sentiment:

- CopyTrader & Crowd Bars: Peek over the virtual shoulder of the community—see what percentage of traders are buying versus selling, or filter the top 2% of investors by track record and risk score to mirror their moves.

- Sentiment Heatmaps: Colour-coded snapshots show where momentum’s heading across stocks, forex and crypto, updated in real time.

Support & Documentation:

eToro’s Help Centre is stuffed with 200+ FAQs, step-by-step tutorials and active community forums steered by eToro staff. When you need a human, live chat is there 24/5, with an average first response in about six minutes. It’s research and support rolled into one neat package—so you spend less time hunting for answers and more time trading with confidence.

(Credit: eToro/NeoSpot)

Opening an Account

Getting started with eToro is straightforward, and you don’t need to be a finance whizz to get going. The signup flow is clean, jargon-free, and most users are verified in under 24 hours.

- Sign-up time: Around 10 minutes from account creation to uploading ID.

- Documents accepted: Passport, driving licence or national ID. Proof of address is only needed for deposits over £2,000.

- Minimum deposit: £10 for UK users.

You can fund your account using UK Faster Payments, debit/credit cards (Visa or MasterCard), PayPal, Skrill or Neteller. E-wallet deposits and card payments usually land instantly, while bank transfers can take 1–3 business days. Withdrawals are free for GBP and EUR; USD withdrawals cost $5. The minimum withdrawal amount is £30.

- Withdrawal time: 1 working day for e-wallets and cards; up to 3 for bank transfers.

- Inactivity fee: £10/month after 12 months without login—avoid this by simply logging in.

Accessibility is solid: eToro’s site and app offer high-contrast display, scalable fonts, and screen-reader labels. The platform is fully translated in English, French, German, Italian, and Spanish.

- Security: Face ID or fingerprint login is supported on mobile, and you can enable 2FA for an extra layer of protection.

- Support: Live chat is available 24/5; average response time is under 10 minutes. Email support typically replies within 12 hours.

If you’re after more community or guidance, the built-in social feed is an active space where investors share charts, strategies, and trade ideas—useful if you’re just starting out. Plus, Club members can attend monthly meetups in London, which are equal parts networking and market discussion.

Final Verdict

If you’re looking for a platform that balances usability, regulation, and access to a wide range of markets, eToro hits the mark—especially for beginners and hands-off investors.

Who it suits best:

- New investors drawn to copy trading and curated Smart Portfolios.

- Part-time traders wanting £0 commission on UK and US shares.

- Crypto fans who prefer one platform for both trading and holding.

- Those exploring ESG or themed investing without needing a separate toolset.

Who might look elsewhere:

- Pro day-traders chasing ultra-fast fills and direct market access.

- Institutional clients who need custom APIs or FIX integration.

- Bond-focused investors—limited access and no real bond market depth.

The bottom line

eToro isn’t perfect. Its CFD costs are higher than some specialist brokers, and it won’t please high-frequency traders. But for most UK-based investors—especially those who value simplicity, regulation, and social features—it’s one of the most versatile all-in-one platforms out there.

CFD disclaimer: 75% of retail CFD accounts lose money. You should consider whether you can afford to take the high risk of losing your money.

*0% commission on stocks & ETFs; other fees (spreads, overnight) may apply.

Frequently Asked Questions

Q. Is eToro regulated by the FCA? A. Yes. eToro (UK) Ltd is authorised and regulated by the Financial Conduct Authority under Firm Reference Number 583263.

Q. Is eToro safe? A. Yes. Client funds are held in segregated accounts at tier-1 banks, and FSCS protection covers up to £85,000 per eligible UK client.

Q. What fees does eToro charge for UK share trading? A. eToro charges £0 commission on UK stocks for Invest and ISA accounts. However, a 0.5% Stamp Duty applies, and FX fees may apply to non-GBP deposits or trades.

Q. What is eToro’s currency conversion fee? A. Currency conversions are charged at 0.5% on deposits, withdrawals, and trades involving non-USD assets.

Q. How can I avoid inactivity fees on eToro? A. Simply log in at least once every 12 months. If you don’t, a £10 per month inactivity fee is charged.

Q. How long do eToro withdrawals take? A. Withdrawals are processed within 1–2 business days. UK Faster Payments usually arrive within 24 hours after processing. A £5 fee applies to USD withdrawals.

Q. Does eToro offer a Stocks & Shares ISA? A. Yes. eToro provides a tax-efficient Stocks & Shares ISA with zero commission on UK shares and a £1,000 minimum deposit.

Q. Can I trade cryptocurrency on eToro? A. Yes. You can buy and sell 60+ cryptocurrencies with a 1% transaction fee. Assets can be transferred to eToro’s crypto wallet for off-platform storage.