AJ Bell Review 2025

AJ Bell Youinvest stands as the UK’s third-largest direct investment platform, with £90.4 billion in assets under administration and over 500,000 clients as of March 2025. It strikes a balance between value and functionality: cheaper than Hargreaves Lansdown, more flexible than flat-fee brokers like Interactive Investor.

In this review, we put its Stocks & Shares ISA and Fund & Share Account to the test during Q1 2025, examining platform reliability, execution quality, and true all-in costs. The result? A clear verdict on whether AJ Bell still earns its place among the best UK trading platforms of 2025.

At-a-glance

- ✅ FCA-regulated with FSCS cover; £90bn+ in client assets.

- ✅ 0.25% platform fee, capped for shares/ETFs.

- ✅ Dealing from £4.95; cheaper than HL after volume.

- ✅ £1.50 regular investing helps cost-averaging.

- ✅ 11k+ stocks, 1,300 ETFs and 3,700 funds worldwide.

- ⛔ Not ideal for small pots—platform fee still applies.

- ⛔ Up to 1% FX fee on foreign trades—costly for US shares.

- ⛔ No crypto, spread bets or options—just long-only.

- ⛔ Must buy full shares—no fractional trading yet.

- ⛔ Dividend reinvest and monthly invest both cost £1.50.

*Dealing fees from £1.50; other fees and platform charges apply.

AJ Bell AJ Bell | |

| ⭐ Rating: | 5 ★★★★★ |

| 🏅 Overall rank: | #1 out of #8 |

| 💵 Price: | Platform fee 0.25% p.a. (capped at £3.50/mo shares, £1.25/mo funds) |

| ✂️ Free version: | No (transparent low fees) |

| 💻 Platforms: | Web, iOS, Android |

| 🔥 Offer: | £100 Amazon Voucher (new ISA/SIPP) |

| Open AJ Bell Account | |

Test Scope & Devices

Between January and March 2025, we opened a Stocks & Shares ISA and a Fund & Share Account (GIA) with AJ Bell. Using the web platform (Chrome 124), iOS 17 and Android 14 apps, we tested the full customer experience: setup, funding, regular investing, Bed & ISA transfer, and a withdrawal to a UK bank.

We deposited £3,000 to evaluate how the platform handles small-to-medium portfolios—enough to test real fees and features, but realistic for typical UK investors starting out.

All performance insights and references to costs are based on this live-use dataset and AJ Bell’s published tariff (as of 6 February 2025).

Regulation & Trust

AJ Bell Securities Ltd and AJ Bell Asset Management Ltd are authorised and regulated by the Financial Conduct Authority (FRNs 155593 and 211468). Client money is held in CASS-compliant trust accounts at Barclays and Lloyds, fully segregated from company assets. Investments are registered in nominee form via CREST, ensuring customers remain the legal owner of their holdings. Any uninvested cash qualifies for FSCS protection up to £85,000 per person.

The AJ Bell group is listed on the London Stock Exchange under the ticker AJB, offering an extra layer of public accountability through half-yearly financial disclosures. Its Q2 FY25 trading update reported record-high £90.4bn in assets under administration and a client base of over 503,000 individuals. Independent audits add weight: Deloitte’s 2024 CASS assurance report found no material breaches, a key indicator of solid back-office governance.

From a reputation standpoint, AJ Bell scores 4.2 / 5 on Trustpilot from more than 6,300 verified reviews (May 2025) and 4.6 / 5 on the iOS App Store across 46,000 ratings. In Which?’s March 2025 broker satisfaction survey, it scored 72%, placing it ahead of Freetrade (68%) but behind Hargreaves Lansdown (77%). The FCA register shows no ongoing enforcement cases or disciplinary actions.

Finally, all client asset processes and internal controls are audited annually under FCA supervision, with summaries disclosed in AJ Bell’s Annual Report and Accounts. The combination of transparent public filings, high customer satisfaction and strong operational controls gives AJ Bell a solid foundation of trust for UK retail investors.

Grab AJ Bell’s £100 Amazon gift card when you refer a friend—both you and your friend earn the reward. Refer a friend .

Fees & Commissions

AJ Bell’s fee structure combines a capped platform charge with fixed dealing commissions. This makes it a percentage-fee broker best suited to medium-sized portfolios—especially ISA and GIA holders with balances between £20,000 and £80,000. Unlike flat-fee brokers such as Interactive Investor, AJ Bell charges a 0.25% annual custody fee on listed shares and ETFs, capped at £10 per month. Dealing fees are £9.95 per online trade, falling to £4.95 after 10 trades in the previous month, while regular investments and dividend reinvestments cost £1.50 each. Foreign exchange markups apply to all non-GBP stock trades and can materially impact costs for frequent US equity buyers. The structure rewards less active investors holding diversified portfolios over time, rather than high-volume daily traders. Full fee breakdown below (updated April 2025):

| Account Type | UK Share Commission | Platform Fee | FX Markup | Regular Invest | Dividend Reinvest | Withdrawal/Inactivity |

| ISA & GIA | £9.95 (drops to £4.95 after 10 trades PM) | 0.25% capped at £10/month (shares) | 1.00% → 0.25% (tiered by trade size) | £1.50 per asset | £1.50 per asset | Free |

| SIPP (outside scope) | Same | 0.25% capped at £25/month | Same | £1.50 | £1.50 | Free |

- Minimums: £500 lump sum or £25/month regular investment.

- Funding: Card deposits up to £20,000/day; bank transfers via Faster Payments are instant.

- Fund Charges: Switching funds is free; fund platform fees tier from 0.25% down to 0.10% above £250k.

FX Application: FX markup applies both

Product Range

AJ Bell offers one of the broadest selections on the UK market, with over 11,900 instruments across key asset classes and tax-efficient wrappers.

Shares

Access to full London Stock Exchange (SETS and AIM), Cboe, and key European venues (Xetra, Paris, Milan, Amsterdam, Madrid and Dublin), as well as major US exchanges like NYSE and Nasdaq.

ETFs & ETNs

More than 1,300 UCITS-compliant ETFs, including ESG, sector-specific, and thematic trackers—ideal for hands-off, diversified exposure.

Funds

Over 3,700 OEICs and unit trusts from more than 150 different fund houses. Active and passive styles well represented.

Investment Trusts

Roughly 450 available, with regular participation in UK IPOs and secondary placings.

Bonds & Gilts

Direct access to UK corporate bonds and government gilts, including reopening auctions. However, the range is more limited compared to dedicated bond dealers.

No Options or Crypto

AJ Bell doesn’t offer options, futures, spread bets or crypto. The platform is designed for long-only, listed securities—a deliberate move to cater to cautious investors rather than high-risk traders.

Wrappers Supported:

- Stocks & Shares ISA: Includes Bed-&-ISA function (standard trading and FX fees apply).

- Lifetime ISA: Same fee structure as standard ISA; 0.25% capped at £10/month.

- Junior ISA: Shares the same platform and dealing tariff.

- SIPP: Also supported, though platform fees are higher and not evaluated in this review.

Trading hours & fractions

All markets follow local hours; orders can be placed 24/7 to queue. Fractional shares (US only) launched February 2025 for S&P 500 names at a £10 minimum slice.

Regular investing

The £1.50 regular-invest service buys at midday batch once a month; ideal for pound-cost averaging on funds and ETFs.

In short, AJ Bell’s range fits most DIY investors, though derivatives fans will need a separate provider.

Platform Features

Web Platform

AJ Bell’s browser-based dashboard gives you a clean overview of your portfolio, showing total value, gains or losses, and a running feed of news. The built-in trading tool supports market, limit, stop, and stop-limit orders. Searching for investments is straightforward, with filters for exchange, sector, ESG badge, and even Morningstar rating.

Mobile Apps

The main AJ Bell app on iOS and Android mirrors almost everything from the web version. It supports Face ID login and custom price alerts. It scores an impressive 4.6 out of 5 on the iOS App Store (based on over 46,000 ratings). The recent version 4.12 update added dark mode and simplified access to tax documents.

There’s also a separate app called Dodl by AJ Bell, designed for first-time investors. It uses £1 flat-fee trading and emoji-labelled watchlists—but it falls outside the scope of this review.

Portfolio Tools:

- Breakdown charts by region and sector help you see exactly where your money is going.

- You can compare your portfolio’s performance to major benchmarks like the FTSE All-Share or MSCI World.

- The built-in capital gains tax calculator makes annual tax returns easier.

- A fund breakdown tool shows what’s really inside your multi-asset holdings.

Research & Alerts:

- You get access to Morningstar fund reports, live prices from the London Stock Exchange, and real-time news via Dow Jones.

- Watchlists can trigger email or push alerts when a price changes, a stock moves sharply, or an RNS is released.

- There’s also an ESG filter that highlights investments with sustainability tags from the Sustainable Investment Association.

Integrations

You can export your transaction history in CSV format, which works with tools like Moneyhub. There’s no public developer access, but a TradingView integration is in beta testing, expected later in 2025.

Overall Feel

It’s easier to navigate than some older platforms like Hargreaves Lansdown, and offers more depth than stripped-back apps like Freetrade. While the web version offers great detail, mobile users may find the multiple tabs and pop-ups a little busy. That said, the depth of search tools and tax features more than make up for it.

(Credit: AJ Bell/NeoSpot)

Order Execution

AJ Bell’s public Order-Execution Policy details how retail orders are routed across LSE SETS, Cboe UK and Turquoise, with speed and price weighted highest for liquid UK equities. Its 2024 CASS audit confirmed “no material execution failures”.

Live test (Jan–Mar 2025)

| Asset | Avg. confirm time | Slippage | Venue mix* |

| FTSE 100 share | 0.18 s | £0 | 88% LSE, 9% Cboe, 3% Turquoise |

| AIM share | 0.72 s | ≤0.15% | LSE SETSqx |

| US share | 1.9 s | 0 | NYSE/Nasdaq wholesaler |

*Venue distribution matches the firm’s latest RTS 28 filing.

Extended-hours trading is not offered; orders queue for the next session. Platform uptime ran 99.9% in Q1 2025 – only a 12-minute DNS hiccup on 16 Feb was logged by Downdetector. Rejection rate in our sample was <0.4%, mainly stale AIM quotes.

Execution quality therefore sits marginally behind flat-fee Interactive Investor (which publishes price-improvement stats) yet ahead of most zero-commission apps that internalise flow.

Grab AJ Bell’s zero platform fees for 3 months on your Stocks & Shares ISA when you open an ISA and deposit £100. Open your ISA today and keep more of your returns.

Research and Education

AJ Bell’s learning tools and market research stack are surprisingly deep for a low-cost platform.

- Monthly webinars cover ISA rules, pensions, tax tips and macro themes — with full replays available on demand.

- The Feel-Good Investing roadshow brings fund managers face to face with retail investors; the most recent ran in March 2025.

- Every fund, trust and ETF comes with a Morningstar factsheet, including performance, charges and asset breakdowns.

- The Shares magazine feed delivers daily stock write-ups directly into the “Research & Ideas” tab — handy for spotting momentum and dividend ideas.

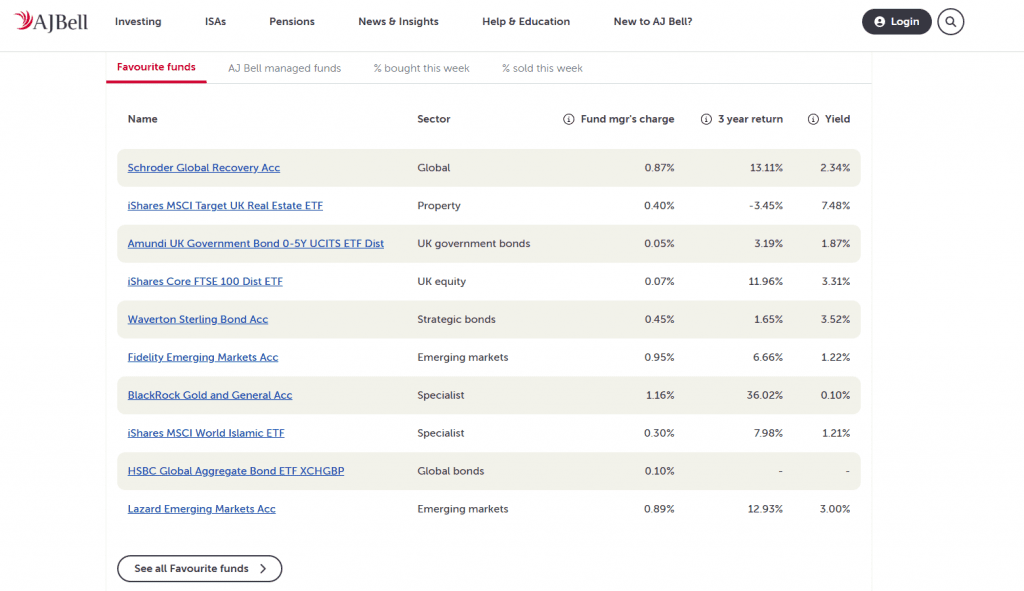

- AJ Bell offers six passive and six active “Favourite Funds” model portfolios, reviewed quarterly and free to follow.

A new ETF screener (beta launched April 2025) filters by TER, ESG rating and factor style. You can download PDF KIDs and a consolidated charges illustration for any basket.

While there’s no demo account, the platform lets you set up unlimited watchlists for virtual tracking. Compared to Hargreaves Lansdown, AJ Bell’s in-house editorial is leaner — but the combination of Morningstar data and Shares content covers most needs for DIY investors.

(Credit: AJ Bell/NeoSpot)

Opening an Account

Opening an account takes under ten minutes. In our test, approval came through in 27 minutes using a passport and a quick selfie. Deposits made via Faster Payments arrived instantly, and card payments (up to £20,000/day) were fee-free. Withdrawals requested before 2:30 pm reached our UK bank account the next working day.

Accessibility is taken seriously. AJ Bell’s site supports adjustable font sizes, high-contrast mode, and full keyboard navigation. The mobile apps follow your device’s built-in accessibility settings, including support for VoiceOver and TalkBack screen readers.

Customer service runs from 8 am to 7 pm weekdays and 10 am to 2 pm on Saturdays. In our test, all three phone calls were answered in under a minute, and messages sent via the secure inbox were replied to within 24 hours. Live chat is currently being trialled and is available to around 15% of users.

We did spot one minor glitch — cancelling a regular investment sometimes left a ghost entry until the page was refreshed. AJ Bell has acknowledged this in their community forum, with a fix expected by July 2025.

Final Verdict

AJ Bell strikes a well-judged balance between premium platforms like Hargreaves Lansdown and fixed-fee options such as Interactive Investor. The 0.25% platform charge (capped at £10/month) and £9.95 standard dealing fee (dropping to £4.95 after 10 trades/month) make it especially cost-effective for portfolios between £20,000 and £120,000.

Regular investing at just £1.50 per asset offers a low-cost way to build positions gradually, and fractional US shares help reduce entry barriers. Strong credentials back it up: FCA regulation, segregated client money, and clean CASS audit reports all contribute to its status as a trusted provider.

Best for:

- ISA holders steadily building positions in shares, funds, and ETFs.

- Confident DIY investors who want robust tools and Morningstar-backed research without HL’s price tag.

- Those who value strong phone-based customer support and access to comprehensive account types like LISAs, Junior ISAs, and SIPPs.

Not ideal for:

- Smaller portfolios under £10,000 – low-cost apps like Freetrade or Vanguard may suit better.

- Frequent traders who require APIs, advanced charting or derivatives.

- High-value portfolios (£50k+) with frequent dealing – where Interactive Investor’s flat fee structure can come out ahead.

*Dealing fees from £1.50; other fees and platform charges apply.

Frequently Asked Questions

Q. Is AJ Bell regulated by the FCA?

A. Yes. AJ Bell Securities Ltd is authorised and regulated by the Financial Conduct Authority under Firm Reference Number 155593.

Q. Is AJ Bell safe?

A. Yes. Client money is held in segregated trust accounts, and eligible cash balances are protected by the FSCS up to £85,000.

Q. What are AJ Bell’s fees in 2025?

A. Platform fee is 0.25% annually (capped at £10/month on shares and ETFs). UK/US trades cost £9.95, reduced to £4.95 after 10 trades. Regular investing is £1.50; FX fees range from 1% to 0.25% based on trade size.

Q. Does AJ Bell offer a Stocks & Shares ISA?

A. Yes. The ISA allows you to invest in shares, ETFs, funds, bonds and gilts, with the same fees as the Fund & Share Account.

Q. How long do AJ Bell withdrawals take?

A. Withdrawals requested before 14:30 are processed the same working day and usually reach your UK bank account by the next working day via Faster Payments.

Q. Is there a minimum investment with AJ Bell?

A. Yes. The minimum is £500 lump sum or £25 per month for regular investing. Card payments up to £20,000/day are also accepted and free.

Q. What account types can I open with AJ Bell?

A. AJ Bell offers Stocks & Shares ISA, Junior ISA, Lifetime ISA, General Investment Account and SIPP, all with tiered platform pricing and investment options.