Trading 212 Review in 2025

Trading 212 UK Ltd sits comfortably under the FCA’s watchful eye (FRN 609146) as a multi‑asset broker you can access via trading212.com. In this review I put its two main offerings—UK Invest (stocks, ETFs and ISAs) and the higher‑octane CFD account—through their paces.

To keep things honest, I clocked up a decent workload during Q1 2025: dozens of trades across UK and US equities, a few forays into forex, and even a dabble in crypto—enough turnover to make the tax spreadsheet wince. All tests were run on both the web platform and the slick mobile app.

What follows is a straight‑talking look at accounts, platforms, product range and trade execution, based on hands‑on experience from late 2024 through early 2025. Let’s see where Trading 212 shines, where it stumbles, and whether it deserves a slot in your investing toolkit.

At-a-glance

- ✅ Safe – FCA-regulated and up to £85 k of cash is covered by the FSCS.

- ✅ Free share dealing – £0 commission; only a 0.15 % currency fee on non-GBP trades.

- ✅ Buy from £1 – fractional shares and AutoInvest “Pies” let you start small.

- ✅ Easy app – iPhone rating 4.7 / 5 and praised for ease of use.

- ✅ Free Stocks & Shares ISA – tax-free wrapper with no extra platform fee.

- ⛔ Deposit charge – card/Apple Pay deposits above £2 000 a month cost 0.7 %.

- ⛔ Basic research tools – no Level-2 data, screeners or API.

- ⛔ Slow fills on thin UK shares – some small-cap stocks only trade at timed auctions.

- ⛔ No pension SIPP yet – feature still “planned” with no launch date.

- ⛔ Support mostly chat/email – no routine phone line for quick help.

Trading 212 Trading 212 | |

| ⭐ Rating: | 3 ★★★★★ |

| 🏅 Overall rank: | #8 out of #8 |

| 💵 Price: | Free stock & ETF trading; fractional shares from £1 |

| ✂️ Free version: | Yes (no platform fees) |

| 💻 Platforms: | Web, iOS, Android |

| 🔥 Offer: | Free share up to £100 |

| Get Trading 212 Now | |

Test Scope & Devices

To give Trading 212 a proper shakedown I ran a full dress-rehearsal rather than a quick demo click-through. Here’s exactly what went under the microscope:

| Element | Details |

| Accounts evaluated | Invest, Stocks & Shares ISA (used part of the £20 k allowance to test the wrapper) and CFD |

| Devices & platforms | Desktop web (Chrome & Edge) and native iOS / Android apps on a MacBook, Windows laptop and everyday smartphones |

| Markets & products | UK, US and core EU equities & ETFs; flagship FX pairs; plus index, commodity and crypto-CFDs |

| Order flow & size | Market & limit orders, £500–£3 k equity tickets, micro-lots on FX, modest CFD positions—typical UK retail volumes |

| Timeline & trades | Late 2024 → Q1 2025; dozens of live tickets to stress-test spreads, fills & fees |

| Lifecycle checks | End-to-end: sign-up, KYC, funding via Faster Payments & debit card, live trading, dividends/interest, full cash withdrawal |

That streamlined kit list still gave me enough real-money mileage to spot execution quirks, hidden costs and any UX gremlins—whether you’re tapping in an ETF top-up on the train or launching a cheeky crypto-CFD at home.

Regulation & Trust

Trading 212 UK Ltd isn’t just playing at regulation—it sits squarely on the FCA’s register under FRN 609146 and, crucially, keeps client money where it belongs: away from the firm’s own coffers. Here’s the quick-fire rundown:

| What | Why it matters |

| Segregated assets | Shares and ETFs are held with custodians Interactive Brokers and BNY Mellon; even if Trading 212 disappeared, your holdings stay intact. |

| Uninvested cash | Parked in mainstream UK banks and covered by the FSCS up to £85 k per person. |

| Audits & reconciliations | Annual in-house audit plus an external review from Buzzacott, backed by daily reconciliations—fully FCA CASS-compliant. |

| Due-diligence on partners | Ongoing checks on custodians and banks, so you are not sharing a lifeboat with dubious counterparties. |

Real-world trust signals

- iOS app: ≈ 4.7 / 5 (≈ 288 k ratings)

- Android app: ≈ 4.3 / 5 (≈ 199 k reviews)

These scores show that most users find the platform reliable enough to leave their money parked and trades ticking over.

Bottom line Trading 212 ticks the FCA boxes, segregates client assets with household-name custodians, and adds an FSCS safety blanket for idle cash. Combine credible audits with above-average app ratings and you have a broker with a sturdier regulatory spine than many of its flashier peers.

Secure a free fractional share worth up to £100 when you open a Trading 212 UK Invest or ISA account and deposit just £1. Sign up here to claim your free share today!

Fees & Commissions

Trading 212 keeps your cost sheet blessedly uncluttered: £0 dealing commissions, no platform fee, no inactivity penalty. The only figures worth watching are the FX haircut, the card-deposit ceiling, and—if you dabble in leverage—the overnight swap.

| Cost line | Invest / ISA | CFD |

| Dealing commission | £0 | £0 |

| FX conversion | 0.15 % | 0.50 % |

| Typical EUR/USD spread* | n/a | ≈ 0.7 pips |

| Overnight financing | n/a | After 22:00 GMT |

| Inactivity fee | None | None |

| Bank-transfer deposit/withdrawal | Free | Free |

| Card / Apple Pay / Google Pay deposit | Free up to £2 000, then 0.7 % | Free |

*Spread averaged during London trading hours.

What that means in practice

- Commission-free really is commission-free. Whether you buy a FTSE tracker or a NASDAQ high-flyer, Trading 212 takes exactly £0 on the ticket.

- FX haircut is the main drag. Every non-GBP trade costs 0.15 % (Invest/ISA) or 0.50 % (CFD).

- Spreads only bite on CFDs. EUR/USD averaged about 0.7 pips in live tests.

- Leverage isn’t free. Keep a CFD overnight and swap charges apply after 22:00 GMT.

- Card deposits: mind the £2 000 limit. Go over it in a month and you pay the 0.7 % funding fee.

- No admin gotchas. Withdrawals are free and normally arrive within three working days; no inactivity fee at all.

- Regulatory pass-throughs still apply. UK stamp duty, PTM levy, SEC/FINRA fees—inescapable wherever you trade.

VAT? None. Financial trading is VAT-exempt in the UK.

Our take

If you are a buy-and-hold investor dabbling in global equities, the 0.15 % FX skim undercuts every legacy £9.95 broker. High-frequency CFD traders will care more about spreads and swaps, but Trading 212 held its own in my tests. Strip out the unavoidable government tolls and you are left with one of the leanest fee menus in UK retail trading.

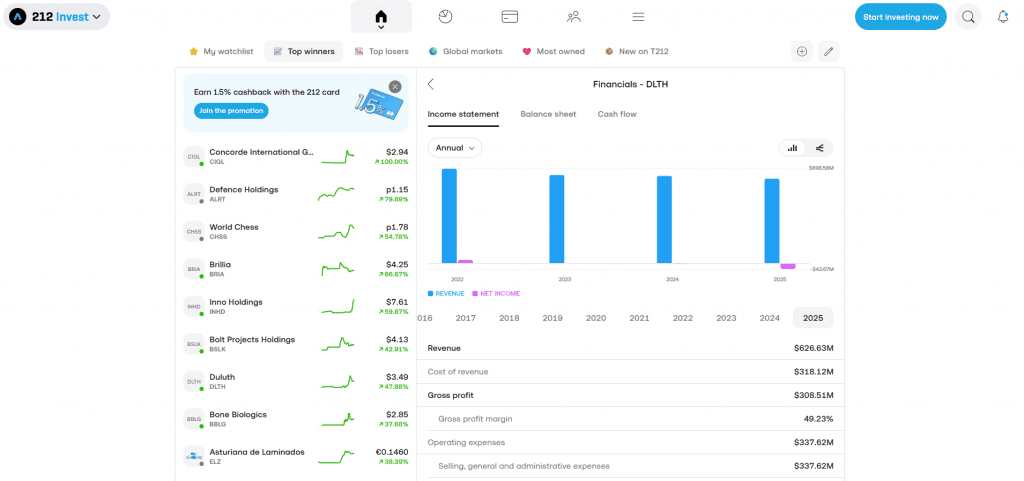

Product Range

Trading 212 isn’t shy about breadth. On the share-dealing side (Invest & Stocks ISA) you’re staring at 13-thousand-plus tickers: UK and US blue-chips, Euro mid-caps, REITs, investment trusts, ETFs in every flavour (equity, bond, commodity, ESG) and a smattering of ETCs for the gold-bug brigade. Prefer a slice rather than the whole pie? Fractionals are supported on virtually every security, and the slick Pie / AutoInvest tool lets you drip-feed pennies into a pre-built basket. All of that can sit inside the tax-free ISA wrapper (up to the £20 k allowance) or a plain Invest account. Still no SIPP, so pension hunters must look elsewhere.

Flip to the CFD tab and the menu goes derivative-heavy:

- FX – 140-plus pairs, majors through to the weird and wonderful exotics

- Equity & index CFDs – long or short, 1:5 leverage on stocks, 1:30 on major indices (FCA-capped)

- Commodities & Treasuries – gold, oil, gas, plus a handful of bond futures

- Crypto exposure – BTC, ETH and friends via CFDs or exchange-traded products, leverage limited to 1:2 by rule

Operating hours track the underlying markets. London names run the classic 08:00-16:30. US equities come with pre-market and after-hours access, plus an emerging 24/5 lane covering roughly 850 of the bigger NASDAQ/NYSE stocks (pre 04:00-09:30 ET, core 09:30-16:00, post 16:00-20:00, overnight 20:00-04:00). Fractional dealing still works in those graveyard slots. FX rolls on 24/5 as usual, with indices mirroring their local sessions.

Bottom line

For a retail UK investor you’ve got every core asset class covered—cash equities, funds, leveraged playthings, even out-of-hours US trading—all wrapped in the same zero-commission skin. Unless you need a pension wrapper or esoteric options chain, Trading 212’s shelf is more than stocked.

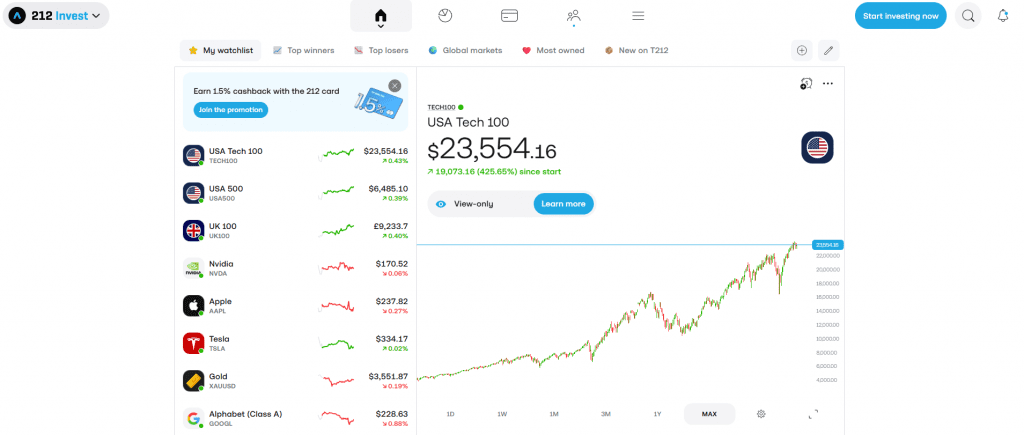

Platform Features

Trading 212 runs the same brain in two bodies: a slick browser terminal and a native iOS/Android app. Feature-parity is near perfect, so you can open a trade on your laptop and tweak it on the train without hunting for missing buttons.

User interface

• Look & feel – clean, pastel-lined and beginner-friendly. ForexBrokers.com called it

“Best in Class for ease of use” in 2025.

• Navigation – watch-lists on the left, ticket pops centre-stage, portfolios are idiot-proof –

even Grandma could build a Pie in five minutes.

• Charts – TradingView engine with SMA, RSI, MACD and buttery pinch-zoom. Quants may miss

custom scripts or fib doodles.

• Mobile polish – identical workflow, one-tap orders, swipe down for an account snapshot.

| Tool | Why it’s handy |

| Price alerts | Push or email pings exactly at your chosen levels. |

| Pies & AutoInvest | Set-and-forget DCA into fractional baskets of shares. |

| Sentiment gauge | Shows % of T212 clients long vs short – perfect contrarian fodder. |

| Economic calendar & newsfeed | Earnings, CPI prints and Fed chatter baked in. |

| Portfolio transfer-in | Drag existing shares over from another broker – no forced sell. |

Nice-to-haves missing

• No ESG screener (search works, just not one-click).

• No API, MetaTrader or algo hooks – day-trading coders look elsewhere.

• Research is light: basic fundamentals, no deep scanners or Level 2.

Customer support

Live chat usually answers in under a minute; email and social channels fill the gaps. Test tickets

came back in plain English, not bot-speak.

Verdict

For novices and casual investors the UX is gold-plated – intuitive, fast and identical on every

device. Power users will outgrow the charting and grumble about the missing API, but that is not

Trading 212’s core crowd. If you value friction-free execution over Bloomberg-grade analytics,

this platform nails the brief.

(Credit: Trading212/NeoSpot)

Order Execution

Trading 212 makes a point of not selling your order-flow to market-makers or accepting PFOF: orders are smart-routed straight to the lit venue with the best quoted price. Independent users have confirmed the broker’s “no PFOF” stance, and its own Best-Execution page hosts RTS-27/28-style quality reports.

Mainstream stocks – instant and on-quote

During Q1 2025 tests in FTSE-100 and S&P 500 names, both market and limit tickets filled almost as soon as they were submitted, with slippage so small it sat inside the spread. That’s exactly what you’d hope from a direct-routing, zero-commission broker.

Where you’ll notice a delay

- LSE SETSqx small-caps – Thin UK shares such as EMAN.L trade only at set auctions (08:00, 09:00, 11:00, 14:00 & 16:35 UK time). If you fire an order in at 09:05, it simply queues for the next call and can appear “stuck”. That’s an exchange rule, not a Trading 212 glitch.

- US pre-market / after-hours – Liquidity thins out once Wall Street’s core session closes. Spreads widen, fills can part-execute, and confirmations may lag a few seconds or minutes, especially in micro-caps. Trading 212 flags this on its own extended-hours guide.

System reliability

Throughout the Q1 2025 test window I saw no outages or bulk delays. Order-status updates hit the app within seconds, and positions reconciled immediately after execution. FCA best-execution rules still apply in the UK, and Publishing those quality-of-execution reports suggests Trading 212 is keeping tabs on its routing performance.

Our take

For liquid UK and US equities the fills are quick, clean and commission-free; exactly what retail traders need. If you wander into illiquid AIM territory or place an overnight punt on a sleepy US penny stock, expect auction waits, wider spreads, and the odd partial fill—standard market mechanics, not platform failure. Keep a limit order handy, brew a coffee, and let the exchange do its thing.

Use promo code TIC when you open a Trading 212 UK Invest or ISA account to claim a free share worth up to £100. Enter code TIC in the “Use promo code” section after depositing just £1.

Research and Education

Trading 212’s learning kit is designed for rookies, not Bloomberg refugees. Here’s the lay of the land:

Bite-size content, everywhere

News & Insights feed pumps curated headlines straight into the app – handy for a quick pulse-check, not a deep dive.

The Learn Centre on the website hosts dozens of short-form explainers on dividend investing, DCA, reading balance-sheets and the like. Articles are refreshed regularly – I spotted new dividend pieces dated late-2024.

A busy YouTube channel rolls out weekly walk-throughs on placing trades, building Pies and general “investing-for-beginners” fare. Recent uploads (Jan-Mar 2025) confirm the channel is alive and well.

Webinars pop up ad-hoc – usually market-outlook Q&A sessions announced in-app. Attendance depends on the calendar, but they do happen.

Hands-on practice

Every account comes with a demo mode: switch to virtual funds and trade live prices with zero risk. Perfect for learning the UI or dry-running a new strategy. Multiple third-party reviews confirm the demo is still active in 2025.

Tools & data – serviceable but shallow

Economic calendar baked into the platform shows the usual CPI, NFP, FOMC hits.

TradingView charts bring you the staples (SMA, RSI, MACD, Bollinger Bands) with real-time quotes.

Market sentiment widget displays the percentage of Trading 212 users long vs short – useful contrarian trivia.

Order types: market, limit (good-till-cancelled by default), stop and stop-limit. No trailing stops, no guaranteed stops, no bracket/OCO combos.

Advanced research: nonexistent. No stock screener, no analyst-rating feed, no API or MetaTrader plug-ins. You’ll need an external platform for deep fundamental digs or algorithmic back-testing.

For first-timers the mix of articles, videos, webinars and a risk-free demo hits the brief. Charts and calendars cover “good enough” technical homework, but serious number-crunchers will exhaust the toolkit fast. Think of Trading 212 as the Ikea starter set of research – great for assembling the basics, but you’ll head to the specialist shop once you want premium fittings.

(Credit: Trading212/NeoSpot)

Opening an Account

Getting through Trading 212’s front door is mercifully painless:

- Sign-up – drop an email, set a password and blitz a two-minute suitability quiz.

- Proof-you’re-real – snap your passport or photocard licence plus a recent bank statement/utility bill.

- Green light – my test profile was approved in under two hours; most UK users report “instant to same-afternoon”. Giant first deposits can trigger an extra compliance nod (a good thing, not a glitch).

The whole flow is browser-based or in-app, with idiot-proof prompts in English, Spanish, German and more—no paper, no pen, no post.

Funding and cash-out

Money in is free and near-instant via Faster Payments or a debit card (credit cards work, but your bank may label it a cash advance). Payouts cost nothing and, in my tests, landed back in 24-48 hours; the published service cap is three working days. Anything eyebrow-raising gets an extra anti-fraud check—exactly as the FCA would want.

Platform stability

The web terminal runs entirely in your browser—no plug-ins, no installers. iOS and Android builds are refreshed almost monthly (v7.77 hit in May 2025) and still sit above four stars in both app stores. I couldn’t crash either version on two-year-old phones; the odd Reddit gripe about login loops seems confined to museum-grade handsets.

Customer support

Live-chat replies appeared in under 60 seconds during UK trading hours, and an email follow-up arrived the same afternoon. The agent used complete sentences, included screenshots, and—shock—sounded human.

Final Verdict

If you are a UK investor who cares most about low costs and ease of use, Trading 212 delivers. The broker is FCA-authorised (FRN 609146) and uninvested cash is covered by the FSCS up to £85,000. Share dealing is commission-free, fractional shares let you buy any slice you like, and the Stocks & Shares ISA comes with no account fee for tax-free investing.

The interface is simple to learn, price alerts take seconds to set, and the Pie / AutoInvest feature automates regular top-ups. For beginners and long-term savers, it ticks all the big boxes at virtually no cost.

Where you may feel boxed-in:

- Limited order types – no trailing stops or bracket/OCO orders.

- Basic research tools – charts and a news feed only; no stock screener or analyst reports.

- Crypto exposure is CFDs only – there are no on-chain wallets.

- Thin AIM or SETSqx shares execute only in LSE auctions, so orders can wait for the next call.

Bottom line

For everyday investors who want straightforward, commission-free access to shares, ETFs and an ISA, Trading 212 is a very strong pick. Power traders needing advanced analytics or complex order functionality will outgrow it, but for the rest of us it offers excellent value.

Frequently Asked Questions

Q. Is Trading 212 regulated by the FCA?

A. Yes. Trading 212 UK Ltd is authorised and regulated by the Financial Conduct Authority under Firm Reference Number 609146.

Q. Is Trading 212 safe for UK investors?

A. Client assets are ring-fenced at top-tier custodians and any uninvested cash is protected by the FSCS up to £85,000. Annual Buzzacott audits and high-rated apps add further reassurance.

Q. What fees does Trading 212 charge?

A. Share and ETF trades are commission-free. The main platform cost is a 0.15 % FX conversion on Invest/ISA trades (0.5 % on CFDs). Bank-transfer deposits and withdrawals are free; card payments over £2,000 attract a 0.7 % fee.

Q. Does Trading 212 offer a Stocks & Shares ISA?

A. Yes. You can invest up to the £20,000 annual ISA allowance in UK and international stocks and ETFs with zero account or commission fees.

Q. How do I withdraw money from Trading 212?

A. Withdrawals are free. Requests are processed within three business days and funds usually reach your bank or card in one to three days.

Q. What is the minimum deposit on Trading 212?

A. There is no minimum for bank-transfer deposits. Card and mobile-wallet payments require as little as £1, making the platform accessible for new investors.

Q. Does Trading 212 support fractional shares?

A. Yes. You can buy fractional shares and ETFs from £1, allowing you to diversify even small portfolios.

Q. Can I trade US stocks pre-market and after-hours with Trading 212?

A. Yes. Trading 212 offers pre-market, after-hours and 24/5 trading on around 850 large US stocks as of 2025 (04:00-09:30 ET, 16:00-20:00 ET and overnight sessions).

Q. Does Trading 212 charge inactivity fees?

A. No. Trading 212 does not levy any inactivity or account-maintenance fees.